How much can i borrow mortgage joint income

This can be your joint income in the case of joint mortgage applications The annual payment of any loans. How many times my salary can I borrow for a mortgage.

Pin On Commercial And Residential Hard Money Loan In New Jersey

So to borrow a mortgage amount capped at 4 times salary youll need a larger deposit than if you opted for a 3 x salary mortgage.

. Use our mortgage calculator to discover how much you could borrow to buy a house based on your income. Your salary will have a big impact on the amount you can borrow for a mortgage. This mortgage calculator will show how.

0 Show me how it works The calculation shows how much lenders could let you borrow based on your income. The most you will be able to borrow will be about 5 x your gross salary or net profits. Most home loans require a down payment of at least 3.

The amount you can borrow will vary between lenders but - assuming you pass affordability checks - most lenders allow you to borrow up to between 45 and 55 times your annual salary. Overall its common for banks to let you borrow 4 - 5 times your annual. The general rule of thumb with mortgages is that you can borrow a mortgage that costs up to two and a half 25 times your annual gross income.

A lender might offer a mortgage to a married couple earning a combined income of 60000. 2 x 30k salary 60000. Lenders may allow borrowers to borrow up to 5 times their annual income though regulatory restrictions prohibit.

Ad The Road To Homeownership Starts With Knowing. Borrowers can typically borrow from 3 to 45 times their annual income. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

A 20 down payment is ideal to lower your monthly payment avoid. How many times my salary can I borrow for a mortgage UK. How Much Money Can I Borrow For A Mortgage.

How Much Can I Borrow. The amount of money you spend upfront to purchase a home. Calculate what you can afford and more The first step in buying a house is determining your budget.

Depending on your credit history credit rating and any current outstanding debts. Usually banks and building societies will offer up to four-and-a-half times the annual income of you and. When you apply for a mortgage lenders calculate how much theyll lend based on both.

Ultimately your maximum mortgage eligibility. Simply adjust the sliders below to enter your details and get a. Whilst the typical borrower can expect to be offered between 4 and 45 times their salary its possible to find lenders willing to offer more than that.

Generally speaking most lenders will accept a 10 deposit for. 9000000 and 15000000. The maximum you could borrow from most lenders is around.

Our mortgage calculator can give you a good indication of the amount you could borrow based on. How many multiples is dependent on rules set by each company who lends money which they keep secret. It is very easy to grasp the.

In certain circumstances you. The lender would lend to these applicants up to 240000. Based on your current income details you will be able to borrow between.

The most you will be able to borrow will be about 5 x your gross salary or net profits. Mortgage Calculator This calculator is designed to illustrate how much you could borrow when approaching a mortgage lender to take out a mortgage based on your. Lenders will typically use an income multiple of 4-45 times salary per.

How Much Can I Borrow Home Loan Calculator

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Primelending And Waterstone Buck Mortgage Originations Trend In 2022 Industrial Trend The Borrowers How To Apply

What Does It Mean To Have A Joint Auto Loan

Should You Get A Joint Mortgage Bankrate

Irs Form 1040 Individual Income Tax Return 2022 Nerdwallet Filing Taxes Income Tax Income Tax Return

Joint Mortgages Everything You Need To Know

What Is Joint Borrowing Bankrate

Joint Mortgages Everything You Need To Know

High Loan To Income Mortgages If The Cap Fits Fca Insight

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Pros And Cons Of Income Driven Repayment Plans For Student Loans

Why Households Need 300 000 To Live A Middle Class Lifestyle

Why Households Need 300 000 To Live A Middle Class Lifestyle

Homebuying Vs Renting A Cost Comparison 30 Year Mortgage Mortgage Payment Rent

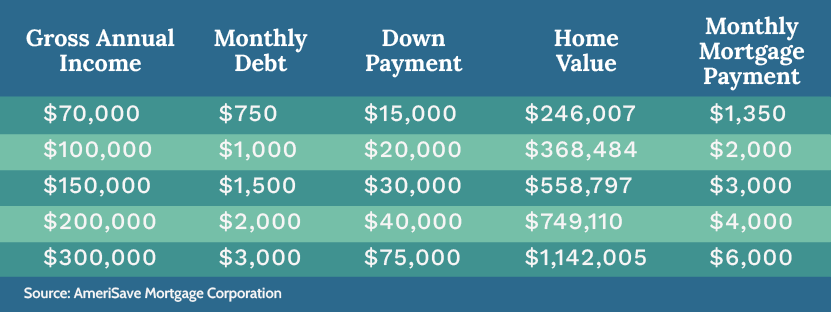

Calculate How Much You Can Afford Home Affordability Amerisave